The Ultimate Guide To How Much Over Asking Price Should You Offer? Here's How

The Home Buyers' Greatest Challenge: How to get an offer accepted in this market! - JohnHart Real Estate Blog

Excitement About Should I sell my house? Tips for how to get the best offer

Have a top limitation to your deal price due to the fact that you're also conserving for retirement and love beach trips? Stay with it. Desire a vegetable garden or to paint your home's outside purple? Ensure your property owners association guidelines permit it. Besides reading HOA guidelines, discover just how much the HOA has in reserves to cover typical area repairs.

How to Make a Competitive Offer on a Home: 6 Tips to Follow

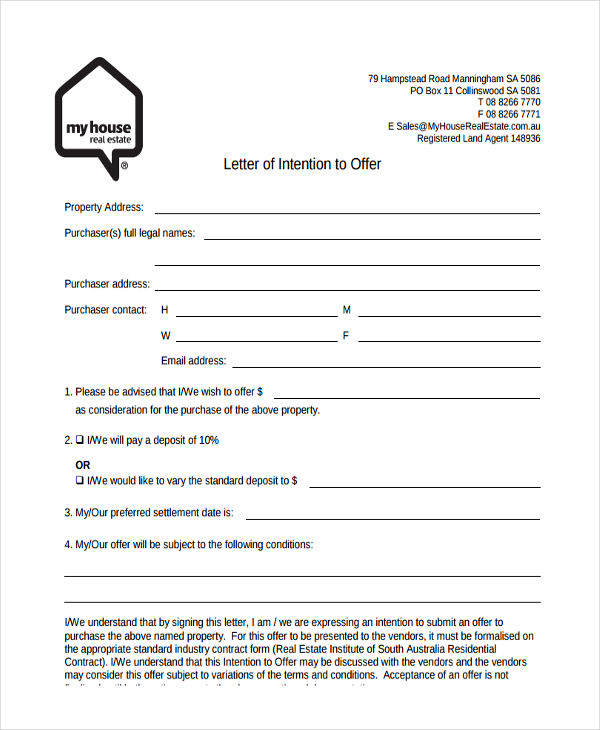

Desire a dog-friendly neighborhood? Make certain there are no family pet weight limits avoiding you from cohabitating with your (extra-large) canine bestie. # 2 Learn to Speak "Contract" Essentially, a deal is a contract. The files and wording differ throughout the nation. In the spirit of due diligence, take some time to review sample offer types before you have actually found a house ( has purchase contracts for each state).

Your agent will have offer forms for your state. # 3 Set Your Rate Houses constantly have a listing price. Consider it as the seller's opening quote in your settlement to purchase a house. As Did you see this? , your offer will consist of an offer cost. This is the very first thing home sellers look at when they receive a bid.

The Ultimate Guide To How to Get Your Offer Accepted in Today's Hot Seller's Market

Several elements can likewise impact your bargaining position and deal rate. For example, if the house has actually been resting on the market for a while, or you're in a buyer's market where supply exceeds demand, the seller may be willing to accept an offer that's below the list price. Or if the seller has actually already received another deal on the home, that might affect the rate you're willing to provide.

# 4 Find out Your Down Payment To get a home loan, you have to make a deposit on your loan. For standard loans (instead of federal government loans), making a 20% down payment allows debtors to prevent having to pay private mortgage insurance coverage (PMI), a monthly premium that protects the lender in case the borrower defaults on the loan.

In truth, the mean down payment in 2019 for buyers in general was 16 percent, and 6 percent for novice purchasers, according to the National Association of REALTORS. Your loan provider will assist you identify what the finest down payment quantity is for your financial resources. Depending upon the type of loan you get, you may even have the ability to put down as little as 0% on your home mortgage.